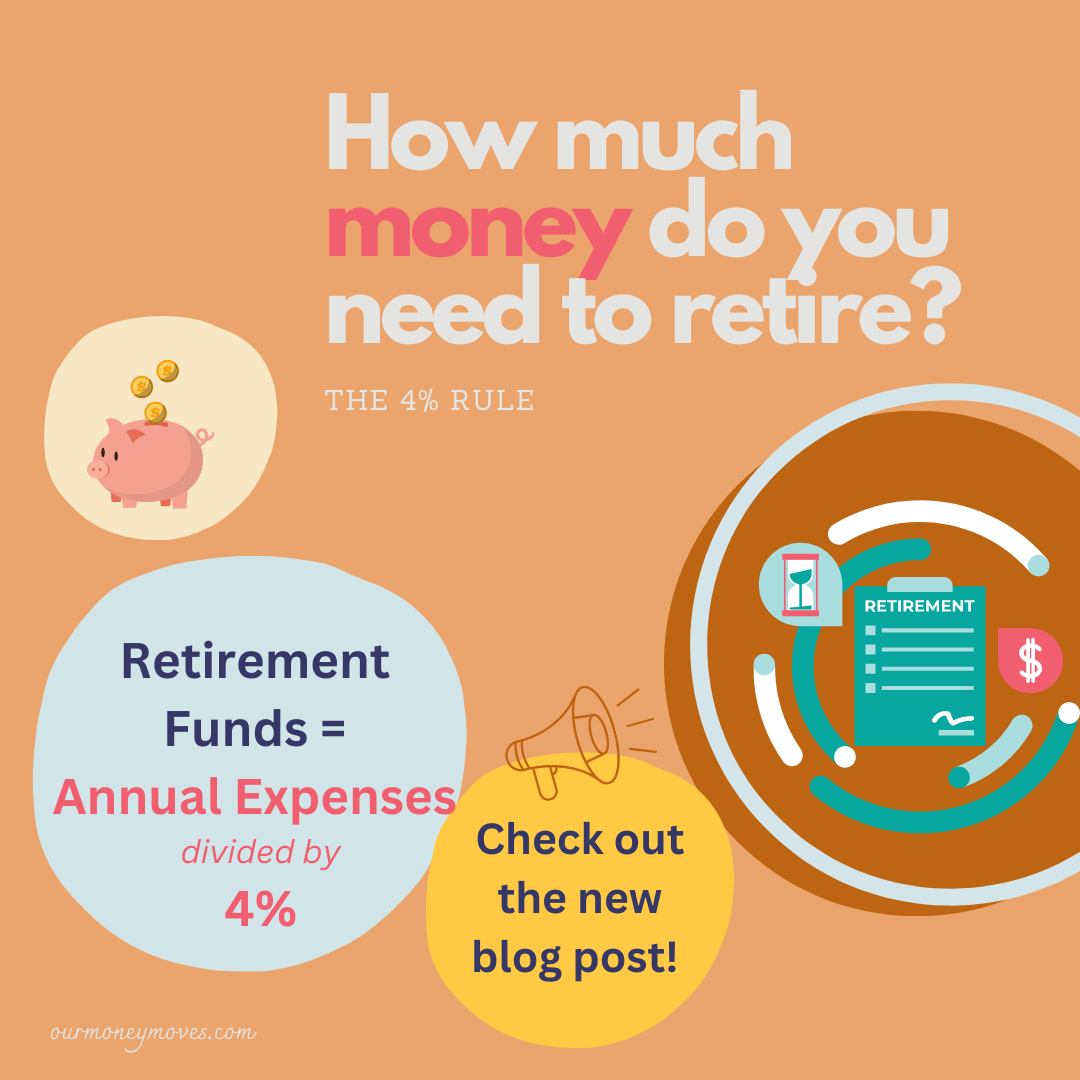

No matter if you are planning to retire early or just adhere to a more conventional retirement age, you need to prepare for retirement way ahead of time to ensure you will be able to maintain your lifestyle and live comfortably through retirement. Ever heard of the 4% rule? It can help guiding you to assess how much money you need to hopefully never run out once you’ve stopped working.

Estimate your number with the 4% rule

Here is how to estimate your number:

- The general wisdom aligns on saying that your annual expenses should be around 70-80% of your current annual expenses. You may be done paying for some of your assets (real estate) or reimbursing debts (education, cars).

- Once you have identified an annual expense amount you think you can stick to throughout your retirement, you divide it by 4% : annual expenses / 4% . For example, let’s say you need $100,000 annually for your household. Then your goal is to have $2.5 millions saved to be able to retire comfortably.

Why 4%? Funny you should ask! Let’s take a look at where is that 4% coming from.

But what is the 4% rule

Back in 1994, Bill Bengen devised what is now known as the 4% rule. The idea is that if you only withdraw 4% of your assets each year to support you during retirement then you shouldn’t run out of money. To explain it very simply, we can think of it as :

- a portfolio is returning an average 10% (index funds tracking the S&P500)

- inflation is eating about 3%-6% yearly so cost of life is more expensive

- there is about 4% left without risking exceeding returns + inflation

This 4% would be a “safe withdrawal” rate. Note that this is not so much of a rule but more so the results of researches taking into consideration inflation, compounding interest and historical returns. It also assumed a 50%-50% portfolio of bonds and stocks and estimated a 90% chance of success of not running out of money over a 30 years timespan.

There has been some back and forth during the last few years to try to determine if this finding still stands considering the very high inflation and high cost of bonds we’ve been seeing. Experts, Bill Bengen among them, seems to think we may need to be more conservative. A new withdrawal rate of 3.3% might be on the safer side.

What about the Canada Pension Plan

Most countries have some kind of system in place to support their retirees in some manner. Personally, I am Canadian. (So Canadian than a few days ago, I went cross-country skiing. So what are you asking? Well I didn’t have to drive anywhere to do so, I just opened my front door. I digress.)

Anyway, I took a look into the Canada Pension Plan to see how this help with our retirement objectives.

An overview of the CPP

If you’ve been contributing and paying taxes in Canada, you will also be able to benefit from the Canada Pension Plan (CPP). Let’s have a look at some numbers to better understand this pension plan and how it will add to your retirement nest egg.

- In 2023, an employee contributes 5.95% of their gross pay (up to a limit) towards the CPP, and their employer match this percentage.

- The maximum pensionable earning is $66,000 in 2023. That makes the maximum amount the employer + employee contribute to the CPP equals to $7,508.90 for one year (2023).

How much money can you receive with the CPP

The amount you will receive is depending on:

- how much you’ve contributed across the years

- how much did you earn during your working years

- how soon are you deciding to start receiving the CPP pension.

For 2023, the maximum monthly amount you could receive as a new recipient starting the pension at age 65 is $1,306.57. The average monthly amount paid for a new retirement pension (at age 65) in October 2022 is $717.15.

How to capture this when estimating your retirement number

Actually, I’d rather not count it in when trying to save towards my own retirement nest egg. I am glad it will provide my household with a little additional income at some point but that’s about it.

Let’s go back to the previous example: a 2 people household wants to have $100,000 available as their monthly spend in retirement. That means they need $8,333 monthly. Now let’s say they are each eligible to receive $717, so a total of $1,434. This household would need to save enough to safely withdraw $6,899 each month ($82,788 annually). So if they plan to retire at a conventional age (65) when maximal pension kicks in, the new nest egg value they have to put aside themselves is $2,069,700. .

Why they should probably still aim for a $2.5 mil nest egg :

- They will need to consider a full $100,000 of spending for every additional year of retirement they plan before 65.

- The pension amount is fairly small.

- Adjustments are made yearly to try to keep up with inflation and other variables

- Each new government coming in could also decide to change eligibility conditions to this pension, such as increasing retirement age to 67 for example.

The magic of compounding

Alright, so our couple needs to put aside $2.5 millions and they pretty much have to get that number on their own because the CPP is… limited. But remember the key aspect of the 4% rule is the return rate. Hopefully, a large part of your retirement amount will come from interest. The longer your money works on the market, the more compounding will happen. That’s why it makes sense to start saving for your retirement early on in your career.

On the graph below, a person is targeting to save $1,260,000 by age 60 so they can retire. You can see how much money you would need to save monthly based on at what age they start.

What if I want to retire really early?

Health-adjusted life expectancy is 69

In Canada, the average age for retirement was 64.6 in 2022. Life expectancy was 81.75 in 2020 but life expectancy with good health (HALE, Health-adjusted life expectancy) is around 69. So if you retire at 65, you’ll have in average only 4 years ahead of you to fully enjoy your retirement. After reading this depressing statistic, you are left with the two options below:

- You do your best to land the most amazing job/industry you won’t want to retire from

- You make sure you are taking the right steps to retire, rather sooner than later

There has been a mindset shift among millennials and Gen Z and we now see people working towards retiring in their 30ies or 40ies. Recently, the COVID-19 pandemic has even more so encouraged people to reflect on their lives and reset priorities. People are re-imagining their work-life balance, looking for purposeful roles and fulfilment. Achieving financial freedom, a.k.a. retiring early, is the royal path for you to have the time to focus on what really matters.

Even if one assumption of the 4% rule is that one will withdraw money over a 30 years timespan, it is still the rule that guide most people working towards early retirement when estimating their number. Mr Mustache, one of the most influencing person in the FI/RE (Financially Independent / Retire Early) community explains that there is very little difference between a 30 years period and an infinite period. Hence, the 4% rule would still stand.

On another hand, most people reaching financial independence early are looking to become work-optional. It is not so much about stopping to work but more so about working on their own terms and not through a conventional 9-5 that was probably not fulfilling. So they may still earn some kind of income.

A few call-outs about the 4% rule

Ready to estimate your retirement number and work towards it? Keep in mind there is always a risk, no matter what withdrawal rate you pick. I guess you could probably bump up your number by a couple of millions to mitigate the risk (easy peasy, amiright).

It is all about finding the balance you are comfortable with. So what are some of the issues of the 4% rule?

What if you annual expenses change ?

Maybe you are done paying off your mortgage? That is the easy situation: your expenses go down. Then you may want to reevaluate the amount and decide how to handle your money (maybe gifting some to your children before you pass away). Cool stuff.

What if your expenses are increasing? This is not a situation you want to find yourself in. If you really have to increase your expenses, you could still try to compensate the incremental amount with a side hustle of some sort. In that case, it better be a side hustle you enjoy, and not a “trying your time” kind of thing. (More about side hustles here). You could also risk to retire a little bit over your own “safe withdrawal rate” if that is what you need. No easy solution there.

The 4% rule is based on past performances

Past performance does not guarantee future performance. That is very much true of any type of investment. There is no guarantee whatsoever that it will work as predicted in 30 or 40 years from now. Or even in 2 years from now! When looking at the past couple of pandemic years, the stock market is everything but stable.

A balanced portfolio is key

Bengen’s finding applied to a specific portfolio mix: 50% stocks and 50% bonds. Reading through the internet, it seems that many people forget about this. Typically, when stocks decrease, bonds increase and the other way around. During the last couple of years, we’ve seen a decrease in both bonds and stocks. This is misleading and maybe one of the reason why the importance of a balanced portfolio. Let’s conclude with this: it is important that your portfolio is always properly balanced, and even more so when closer to retirement.

One response to “The 4% rule: how much money do you need to retire”

Nous avons écouté une émission politique ce soir en France avec comme intervenant Luc Ferry ancien ministre de l’éducation nationale et Daniel Cohn-Bendit député européen qui échangeant sur l’âge de départ à la retraite et le changement des mentalités très récent principalement du à la pandémie. Il y a 10 ans 70% des français voulaient travailler plus pour gagner plus en 2022 70% des français veulent profiter de leur vie partir à la retraite plus tôt même si il y une décote et mettent l’accent sur le plaisir le retour à la nature et profiter de la vie.

Mettre de l’argent de côté le plus vite possible est évidemment le bon choix mais il nécessite aussi d’avoir un bon salaire pour vivre décemment et pouvoir le faire. Or au moins 25% de la population est au smic donc moins de 1350€ net par mois. Une personne seule peut difficilement y parvenir. Pour un couplé sans enfants cela est possible. Pour un couplé avec enfants ça reste compliqué.

Il faut donc tenir compte de son salaire et prévoir sa retraite n’est oas simple….